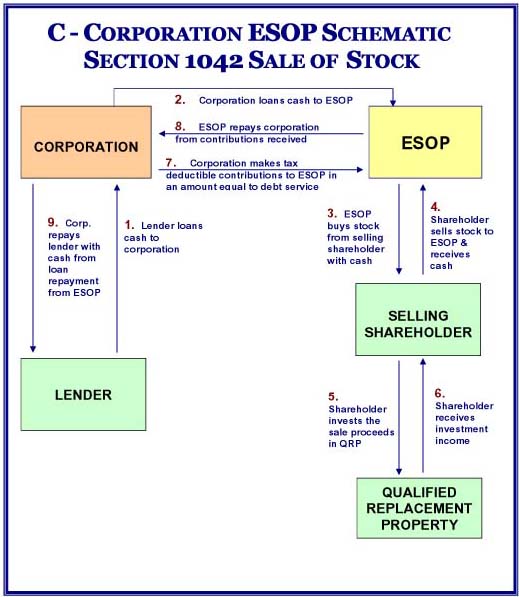

Sample ESOP Transaction |

This section contains a diagram of a Section 1042 tax deferred sale of stock to an ESOP along with a list of the steps in the transaction, the benefits of the transaction, and a comparison of the financial advantages of the ESOP sale vs a non-ESOP sale. |

In this example we are assuming that a shareholder with an effective zero basis sells $10,000,000 of privately held stock to an ESOP under the parameters of Section 1042 and defers the capital gains tax in the transaction. We assume the seller is in the combined Federal and State capital gains tax bracket and that the corporation is in the 40% tax bracket. |

Benefits To The Selling Shareholder: |

|

|

|

|

|||

|

|

|

|

|

|

|

|

Section 1042 Comparison of Benefits |

|||||||

|

|

|

|

|

Non-ESOP Sale |

ESOP Sale |

|

Gain on sale of the stock by seller |

|

$10,000,000 |

|

$10,000,000 |

|||

Seller's capital gains tax at 25% |

|

|

$2,500,000 |

|

0 |

||

Net sale proceeds to the seller |

|

|

$7,500,000 |

|

$10,000,000 |

||

|

|

|

|

|

|

|

|

Additional Income Generated To Seller From Investment Of The Tax Savings |

|||||||

|

|

|

|

|

|

|

|

Additional tax savings available to invest |

|

0 |

|

$2,500,000 |

|||

After tax yield on invested tax savings |

|

5% |

|

5% |

|||

Additional annual investment income generated |

0 |

|

$125,000 |

||||

Remaining years to life expectancy |

|

20 |

|

20 |

|||

Additional lifetime income generated on tax savings |

0 |

|

2,500,000 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Benefits To The Corporation For Deduction Of Principal Payments: |

|

||||||

Both principal and interest payments are tax deductible by the corporation on ESOP loans. |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-ESOP Sale |

ESOP Sale |

|

Tax deduction for $10,000,000 principal on debt service |

0 |

|

$10,000,000 |

||||

Corporate tax savings on deductible principal (40%) |

0 |

|

$4,000,000 |

||||

After tax cost of principal repayment |

|

$10,000,000 |

|

$6,000,000 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Savings For The Selling Shareholder And The Corporation |

|

|

|||||

|

|

|

|

|

|

|

|

Sec. 1042 tax savings for selling shareholder |

0 |

|

$2,500,000 |

||||

Shareholder's additional lifetime income generated |

0 |

|

$2,500,000 |

||||

Corporate tax savings on deductible principal repayment |

0 |

|

$4,000,000 |

||||

TOTAL ESOP Benefits Generated |

|

0 |

|

$9,000,000 |

|||

STEPS IN THE SECTION 1042 SALE OF STOCK TO THE ESOP

THE BENEFITS OF THE SECTION 1042 SALE OF STOCK TO THE ESOP

|